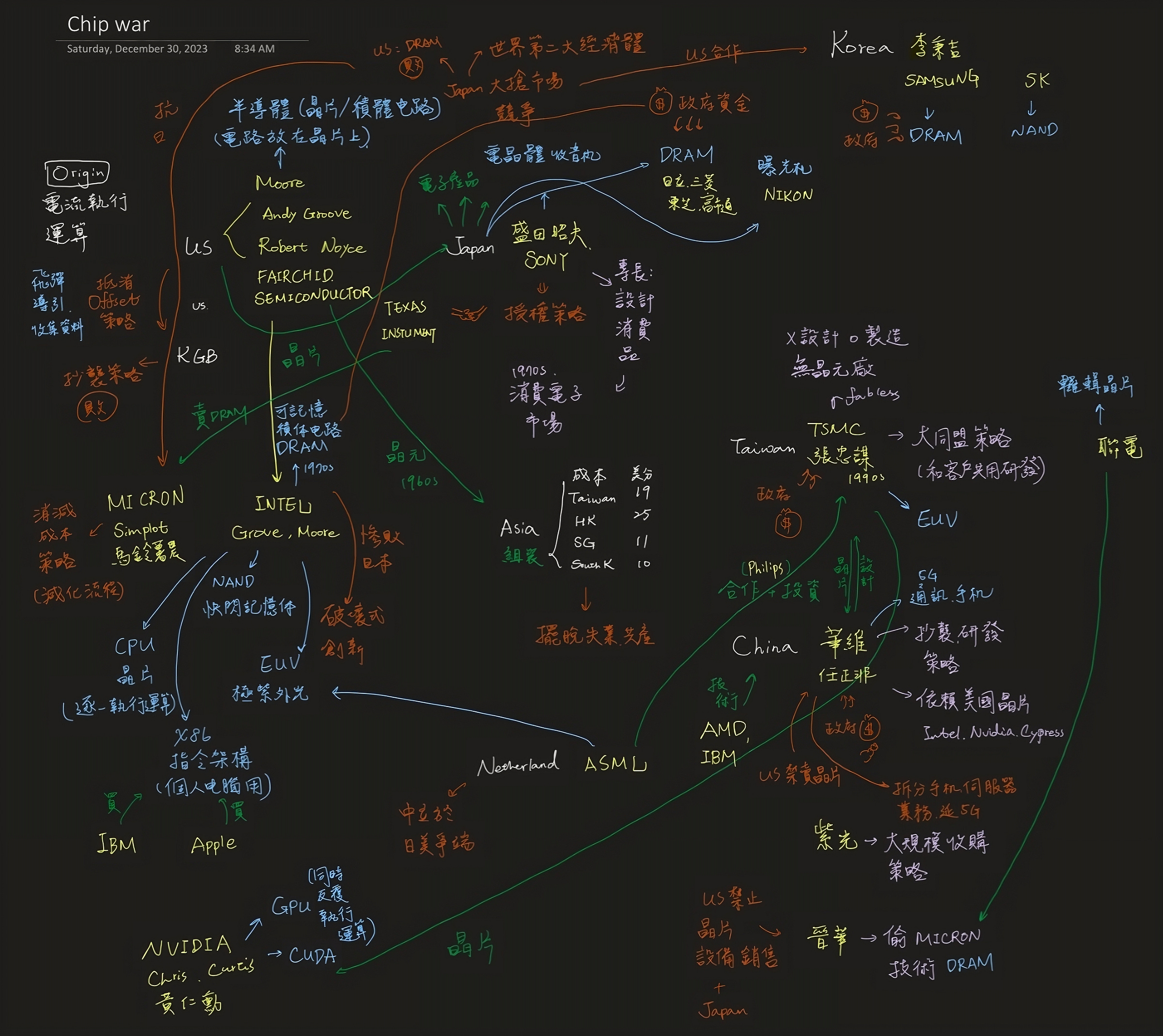

晶片戰爭解析 Chip War Analysis

科技、政治、經濟三股力量的交互影響 How technology, politics, and economy interact with each other

當我朋友聽說我在讀晶片戰爭時,第一個反應是「天啊!你真是個書呆子 (nerd)!」我一開始也以為這本書會過度的艱澀,就想說試試看個二十分鐘,沒想到越看越起勁。我認為這本書的價值,不在於晶片產業的技術發展,而是以晶片的發展說明說明近代政治與經濟的發展,讓我看見科技、政治、經濟三股力量的交互影響。

我分成國家層次、企業層次、和企業家層次來做解析,說明科技、政治、經濟三股力量的交互影響。國家的策略導向影響公司的發展方向,而公司的成長則帶動國家經濟與政治實力的發展,進而底定誰是世界的霸權,與國際政治的關係。像是美國的自由市場下的矽谷創新帶領美國晶片的不斷研發,即便在 DRAM (記憶體晶片) 市場完敗日本後透過找到下一波個人電腦的創新,讓晶片產業重新復甦,美國至今是世界強權。但蘇聯的抄襲策略讓蘇聯沒有領先的晶片組織,也在冷戰中遠遠落後美國,失去霸權的地位。反觀日本,採取授權策略和美國合作,加上政府資金輔助,成立索尼、日立、三菱、大型企業們,在 1980 年代晉升世界強權。

國家層次

先談政府好的或壞的策略如何影響企業的發展,最後又怎麼影響國際地位。

蘇聯

以蘇聯為例,蘇聯將晶片的發展作為機密,因此國家最傑出的年輕菁英都不知道投入這項產業,造成人才短缺,而蘇聯的抄襲與共產策略(蘇聯根本沒有企業),也讓蘇聯的晶片技術永遠落後美國,偷了很多晶片,但學不會製程。畢竟矽谷的晶片業發展是以創新為核心,用抄的當然會擁有落後。而科技的技術落後,讓蘇聯的軍事實力大不如前,因為美國可以用晶片收集更多的資料,並且有更新的科技像是飛彈所引系統。蘇聯的飛彈根本不準,最後冷戰結束,蘇聯失去霸權的地位。

中國

中國在毛澤東時代因為漠視知識分子,所以完全錯過晶片的生產,但後來的政策卻都非常努力扶植在相關的在地企業,像是華為、紫光等等。像是中國有「大基金」計畫,要求中國財政部、國家開發銀行、中國煙草公司和投資機構等共同投入資本密集的晶片產業。中國政府頭也補助華為 750 億的補貼,包含土地、信貸稅負減免等等大規模優惠,是西方國家不能比擬的。雖然中國雖然也採向蘇聯一樣的偷竊政策,但是不同於蘇聯,它從矽谷學會研發的重要,華為的年度研發預算為 150 億美元,只有超級大的美國公司,像是谷歌、亞馬遜,可以和他匹敵,華為也在營收不高的時候,就花大錢聘請 IBM 顧問優化他們的生產流程,華為因而能夠製造成品低,但品質佳的產品。2019 年華為的銷量僅次於三星。雖然華為常常遭受偷竊和從事間諜行動的控訴,美國也懷疑華為是中國政府在背後打造的,但他確實讓中國成為出口經濟的強國。

企業層次

從索尼到日立、三菱、東芝、富士通

相反的,個體企業的發展也帶動國家經濟與政治實力的變化。以日本為例,日本以創立索尼 (Sony) 的成田紹夫開始結合運用晶片的技術。日本沒有像蘇聯一樣抄襲,反而透過授權策略,和美國緊密合作,進口美國的晶圓,組裝後放入日本最擅長的電子消費品,出口全世界,因為日本最擅長的就是設計消費品了。因此 DRAM 產業越來越興盛,讓日本脫離二戰的低迷,在 1980 年代成為世界第二大的經濟體,索尼的創辦人成田紹夫著也寫《一個可以說不的日本 》一書。而日本政府政策的扶植也讓日本的 DRAM 產業比美國更有競爭力,儘管當時美國企業說服美國政府把晶片業發展列為國家與軍事要務,但為時已晚,除了美光 (Micron) ,美國的 DRAM 產業幾乎全數陣亡。日本成為經濟與政治強權,讓美國和美國的公司不得不尋求下一階段的創新,和扶植其他亞洲的公司來削弱對日本的依賴。

企業家層次

企業家的思維與公司的發展也密不可分,而他們思維的形塑當然也和他們所受的教育,與身處的背影有關。我要談三個讓我非常敬佩的企業家,美光 (Micron) 創辦人 Simplot,英特爾 (Intel) 創辦人 Grove,與台積電創辦人張忠謀。

美光 Simplot

在美國 DRAM 廠商在日本的競爭下節節敗退時,唯獨美光可以殺出重圍,為什麼呢?因為美光創辦人 Simplot 身為愛德華洲的馬鈴薯農,它雖然不懂晶片,但看到 DRAM 的競爭就明白 DRAM 已經變成大宗商品市場,而大宗商品市場的競爭策略為降低成本,因此他用各種方式簡化流程,成為美國少數存活並且興盛的 DRAM 公司。美國企們們雖然不擅長削價競爭,美國政府也採自由經濟,鮮少補貼,但 Simplot 靠這自己對商品市場的了解帶領美光殺出一條血路。

英特爾 Grove

英特爾則以 DRAM 起家,但在日本慘烈競爭下即將陣亡,英特爾的創辦人 Grove 是匈牙利難民,以偏執為名,曾寫下《十倍速時代,為偏執狂得以倖存》,Grove 決定顛覆自己的記憶體市場。破壞力創新雖然聽起來很有吸引力,但實務上非常痛苦,畢竟公司要亡了。但因為他全盤下注個人電腦的晶片,賭對了,讓英特爾又重新活過來。他的創新精神正正好就是帶領矽谷公司們與美國不斷進步的精神。

台積電 張忠謀

台積電是當時台灣的經濟部長李國鼎說服張忠謀來台灣創立的,台灣政府和 ASML 共同投資資金給台積電,張忠謀離開德州儀器,實踐「無晶圓廠」的計畫。無晶圓廠的概念是這個樣子的,張忠謀想要把晶片的設計和製造分開,讓客戶設計,台積電專心製造。這個策略除了有規模製造的經濟,也避免和客戶競爭,因為英特爾的模式就是同時兼具製造和設計,因此和設計的公司是有利益衝突的,英特爾也得兼顧兩邊,最後變成兩邊都做不好。反觀張忠謀運用「大同盟策略」把客戶們的資金、技術全部集中,雖然客戶彼此間有競爭關係,但台積電和他們都沒有,因此台積電可以裁其中協調,利用客戶的創新,並因此能大量集中研發資金,一起合作。另外,金融危機的時候,其實大家都在裁員、減少支出,但是張忠謀採取相反的策略,大量投資,把被裁員的員工招回來。所以才能在智慧型手機蓬勃發展的時候,領先群雄。張忠謀的策略不只讓台積電成為超大的晶圓工廠,也影響了台灣的在全球政治重要性。

國際層次

最後,我想談談國際政治的影響和對國家與企業發展的影響,為什麼我不放在一開始談呢?因為晶圓開始之初,或許有複雜的國際局勢,但並沒有複雜的國際化供應鏈,只有美蘇之間的競爭。但今天的供應鏈環環相扣,晶片的發展固然影響一國經濟政治地位,但是他的國際關係,也影響國內能夠有的發展。

中國

前面提到中國的急起直追,但是,因為在毛冊東時其錯過了大半,中國的晶片生產,整個生產鏈還是大致仰賴美國,整個半導體的供應鏈中,加總晶片設計、智慧財產權、機台、製造、和其他步驟,儘管 AI 在中國蓬勃發展,中國企業的市佔率其實只有 6%,美國有 39%、南韓 16%、台灣 12% 。所以習近平的 《中國製造2025》計畫裡,就希望能把進口的晶片比率從 85% 降至 30%,畢竟 AI 將會是中國下一波的發展重心,華為卻非常一列英特爾和輝達的晶片,而且下一場軍事競爭,AI 絕對為重要的科技軸心。

但中國不會生產 DRAM 晶片,怎麼辦呢?用偷的。中國公司晉華,和聯電決定合作 DRAM 晶片的製造,但是聯電只會邏輯晶片,又不會 DRAM。因為美國的晶片公司美光在台灣有分公司,所以他們就直接把好幾年和上億的技術,直接偷來,在挖角在台灣的美光工作來做晉華的執行長。消息曝光後,美國原本是完蛋了,因為中國大概 5 年就可以抄襲成功,但是後美光在跟上大概也來不及了。但這個時候,正好是川普的任期,反中的川普政府當然不會只向歐巴馬政府一樣嚴厲譴責,他們決定禁止美國的公司銷售晶片相關設備到中國,然後還聯合日本一起。雖然晶片的生產鏈很複雜,美國並不擁有所以技術的鎖喉點,但是大部分的公司,像是 ASML、台積電,不是美國公司有大量投資,就是有重要的技術、或子公司在美國,所以大家幾乎都會遵照美國的命令。因此美國還是有力量把技術封鎖,晉華雖然偷到了技術,但沒幾個月就倒了。這說明了,縱然中國對在地企業的發展有大量的影響力,在中美緊張的國際局勢下,中國晶片產業的發展也備受限制。

總結

從這本書可以看到,晶片的故事一開始看起來是由科技帶領國家發展,讓美國在冷戰裡獲勝蘇聯,但國家策略也對科技的發展有很大的影響,像是中國是怎麼樣在長期落後的情況下,急起直追,成為手機與 AI 大國。而企業的發展和國家經濟的發展也環環相扣,日本沒有成田紹夫,和電子消費企業們的大量發展,日本是不可能能在二戰戰敗後,經濟快速復甦,成為世界第二大經濟體的。當然,成功的企業們都需要有企業家的智慧,而這些企業家 (Simplot, Grove, 張忠謀)的共通點其實都是大膽投資,大量創新,在公司表現不佳、甚是國家整體產業都表現不佳時殺出重圍。最後,今天的晶片供應鏈已經時候負複雜,全球都在不同的供應鏈的階段上進行研發創新。今天的美國已經沒辦法靠獨自的力量扼殺中國的晶片發展了,儘管暫時透過各種協定,鎖住中國部分晶片的發展,中國早就已經透過進口美國晶片製造的外銷產品成為經濟強國,成為科技強國的一天也指日可待。而下一波 AI 科技技術的發展,將決定下一個世界的政治強權。小小的晶片可以看到這麼多科技、政治、與經濟發展的交互影響,很酷吧。

Chip War Analysis

When my friend heard that I was reading Chip War, their first reaction was, "Wow! You're such a nerd!" At first, I also thought that this book would be overly challenging, so I decided to give it a try for about twenty minutes. To my surprise, the more I read, the more engrossed I became. I believe the value of this book lies not only in the technological development of the semiconductor industry but also in its ability to explain the recent developments in politics and economics through the lens of chip development. It has allowed me to see the interconnected influence of technology, politics, and economics, which is fascinating.

I analyze it from three levels: the national level, the corporate level, and the entrepreneurial level, to explain the interactive impact of the three forces: technology, politics, and economics. The strategic orientation of a nation influences the direction of corporate development, and a company's growth, in turn, drives the development of the national economy and political power, thereby determining who holds world hegemony and their relationship with international politics.

For example, under the framework of the United States' free-market system, Silicon Valley's innovation has continuously led to the development of American semiconductors. Even after losing the DRAM (memory chip) market to Japan, they found innovation in the next wave of personal computers, revitalizing the semiconductor industry. As a result, the United States remains a global superpower. However, the Soviet Union's strategy of imitation led to them lacking a leading semiconductor organization, falling far behind the United States during the Cold War, and losing their hegemonic position.

On the other hand, Japan adopted a licensing strategy and cooperated with the United States, supplemented by government funding, leading to the establishment of companies like Sony, Hitachi, Mitsubishi, and other large corporations, which propelled Japan to become a economic superpower in the 1980s.

National Level

Let's first discuss how government policies, whether good or bad, affect the development of businesses and ultimately influence a country's international status.

Soviet Union

Taking the Soviet Union as an example, they treated the development of semiconductors as a state secret. Consequently, the country's brightest young talent had no knowledge or involvement in this industry, leading to a shortage of skilled personnel. The Soviet Union's strategy of imitation and its communist policies (as they didn't have private enterprises) kept their semiconductor technology perpetually behind the United States. They may have stolen many chips but couldn't master the manufacturing process. Silicon Valley's semiconductor industry, on the other hand, thrived on innovation, so copying naturally resulted in lagging behind. The technological lag handicapped the Soviet Union's military capabilities because the United States could collect more data using chips and had more advanced technology, such as missile guidance systems. Soviet missiles were comparatively inaccurate, and when the Cold War ended, the Soviet Union lost its position.

China

During Mao Zedong's era, China disregarded intellectuals, missing out on semiconductor production entirely. However, later policies made significant efforts to support local businesses in related fields, such as Huawei. China launched the "Big Fund" initiative, urging the collaboration of various entities, including the Ministry of Finance, China Development Bank, China Tobacco Corporation, and investment institutions, to invest heavily in the capital-intensive semiconductor industry. The Chinese government also provided substantial subsidies to Huawei, including land, credit, and tax incentives, unmatched by Western countries. Although China adopted a policy of theft similar to the Soviet Union, it differed by learning the importance of research and development from Silicon Valley. Huawei's annual R&D budget is $15 billion, a figure only rivalled by super-sized American companies like Google and Amazon. Even when Huawei's revenue was not high, they invested heavily in hiring IBM consultants to optimize their production processes, enabling them to produce low-cost but high-quality products. In 2019, Huawei's sales were second only to Samsung. Despite frequently facing accusations of theft and espionage activities, with the United States suspecting Huawei's ties to the Chinese government, it undeniably helped China become an economic powerhouse through exports.

Corporate Level

From Sony to Hitachi, Mitsubishi, Toshiba, and Fujitsu

Conversely, the development of individual corporations also drives changes in a country's economy and political power. Taking Japan as an example, it all began with the technological integration of semiconductors by Masaru Ibuka, the founder of Sony. Japan did not imitate like the Soviet Union but instead employed a licensing strategy and closely collaborated with the United States. They imported American chips, assembled them into electronic consumer products, which Japan excelled at designing, and exported them worldwide. Consequently, the DRAM industry flourished, helping Japan break free from the post-World War II slump and become the world's second-largest economy in the 1980s. Masaru Ibuka, the founder of Sony, even wrote a chapter in the book titled "A Japan That Can Say No."

The support of Japanese government policies also made the country's DRAM industry more competitive than the United States. Despite American companies convincing the U.S. government to prioritize semiconductor industry development for national and military interests, it was too late. Aside from Micron, almost all of the U.S. DRAM industry perished. Japan became an economic and political powerhouse, forcing the United States and its companies to seek the next phase of innovation and support the growth of other Asian companies to reduce their dependence on Japan.

Entrepreneurial Level

The mindset of entrepreneurs and the development of companies are closely intertwined, and their thought processes are naturally influenced by their education and background. I want to talk about three entrepreneurs whom I greatly admire: Simplot, the founder of Micron; Grove, the founder of Intel; and Morris Chang, the founder of TSMC (Taiwan Semiconductor Manufacturing Company).

Micron - Simplot

In the United States, as DRAM manufacturers were retreating from competition with Japan, Micron was the only one to break through. Why? Because the founder of Micron, Simplot, was a potato farmer from Idaho. Even though he didn't understand semiconductors, he saw that DRAM had become a commodity market with fierce competition. In commodity markets, the competitive strategy is to reduce costs, so he simplified processes in various ways, making Micron one of the few surviving and thriving DRAM companies in the United States. While American companies were not adept at price competition, and the U.S. government followed a free-market approach with minimal subsidies, Simplot, with his understanding of commodity markets, led Micron to carve out a path of its own.

Intel - Grove

Intel had its roots in DRAM, but faced with brutal competition from Japan, it was on the verge of collapse. Intel's founder, Grove, was a Hungarian refugee who, under the banner of paranoia, once wrote, "Only the Paranoid Survive: How to Exploit the Crisis Points That Challenge Every Company." Grove decided to disrupt his own memory market. Disruptive innovation may sound attractive, but in practice, it can be very painful, especially when it means the company is on the brink of failure. However, Grove made a bold move by betting heavily on microprocessors for personal computers, and it paid off, revitalizing Intel. His spirit of innovation perfectly exemplified the ethos of Silicon Valley companies and the constant pursuit of progress in the United States.

TSMC - Morris Chang

TSMC was founded in Taiwan after Morris Chang, then Taiwan's Minister of Economic Affairs, convinced him to establish the company. The Taiwanese government and ASML jointly invested funds in TSMC, and Morris Chang left Texas Instruments to implement the "fabless" idea. The concept of a fabless company involves separating chip design from manufacturing, allowing customers to focus on design while TSMC concentrates on manufacturing. This strategy not only leveraged economies of scale but also avoided competition with customers. Intel's model, which involved both design and manufacturing, created conflicts of interest with design companies, forcing Intel to juggle both aspects and ultimately not excelling in either. In contrast, Morris Chang employed a "grand alliance strategy" to consolidate customers' funds and technologies. While the customers themselves had competitive relationships, TSMC had none, enabling it to coordinate among them and utilize their innovations. This allowed TSMC to pool a substantial amount of research and development funds and foster collaboration. Additionally, during the financial crisis when many were cutting staff and reducing spending, Morris Chang took the opposite approach by investing heavily and rehiring laid-off employees. This strategy positioned TSMC ahead of its competitors during the boom of smartphones. Morris Chang's strategies not only transformed TSMC into a massive semiconductor foundry but also influenced Taiwan's global political significance.

International Level

Finally, I'd like to discuss the influence of international politics and its impact on the development of both nations and businesses. Why didn't I start with this? Because at the inception of semiconductor manufacturing, there might have been complex international relations, but there wasn't the intricate international supply chain we have today. Initially, there was only competition between the United States and the Soviet Union. However, today's supply chains are intertwined, and while semiconductor development undoubtedly affects a nation's economic and political standing, its international relationships also impact what domestic development is possible.

China

As mentioned earlier, China has been rapidly catching up. However, because it missed out on significant developments during Mao Zedong's era, China's semiconductor production still heavily relies on the United States in the overall semiconductor supply chain. This includes chip design, intellectual property, equipment, manufacturing, and other processes. Despite the flourishing of AI in China, Chinese companies hold only a 6% market share, compared to 39% for the United States, 16% for South Korea, and 12% for Taiwan. Therefore, Xi Jinping's "Made in China 2025" plan aims to reduce the import ratio of semiconductors from 85% to 30%. After all, AI will be the next focus of development for China, and companies like Huawei are heavily dependent on Intel and Nvidia chips. Moreover, in the next wave of military competition, AI will undoubtedly play a crucial role as a technological axis.

But what about DRAM chips, which China doesn't produce? They decided to acquire them through other means – theft. Chinese companies, including Fujian Jinhua Integrated Circuit, decided to cooperate with Taiwan's UMC (United Microelectronics Corporation) for DRAM chip manufacturing. However, UMC only possessed expertise in logic chips, not DRAM. Since the American chip company Micron had a subsidiary in Taiwan, these companies decided to directly steal their technology over several years, costing them billions of dollars. They even poached Micron employees in Taiwan to become top executives at SMIC. When this news came to light, it seemed like the United States was doomed because China would likely succeed in copying the technology in about five years, and Micron was already lagging. However, this happened during the Trump administration, which was tough on China. Instead of merely condemning China, they decided to impose restrictions, barring American companies from selling chip-related equipment to China, and they also got Japan on board. Although the semiconductor supply chain is complex and the United States doesn't hold all the technology's chokepoints, many companies, like ASML and TSMC, either have significant U.S. investments or important technologies or subsidiaries in the United States. Consequently, most companies comply with U.S. commands. Thus, the United States still had the power to block technology. While Fujian Jinhua managed to steal the technology, it collapsed within a few months. This illustrates that even though China wields significant influence over local businesses' development, the development of China's semiconductor industry is severely constrained under the tense international situation between China and the United States.

Conclusion

From this book, we can see that the story of chips initially appears to be led by technology driving national development, enabling the United States to win the Cold War against the Soviet Union. However, national strategies also have a significant impact on technological development. For instance, we see how China, despite being significantly behind, managed to catch up and become a major player in the smartphone and AI industries.

The development of corporations is closely intertwined with the economic development of a nation. Without entrepreneurs like Masaru Ibuka and electronic consumer companies in Japan, the rapid post-World War II recovery and emergence of Japan as the world's second-largest economy would have been unlikely. Successful corporations need visionary entrepreneurs, and common traits among these entrepreneurs (Simplot, Grove, Morris Chang) include bold investments, significant innovation, and the ability to turn the tide when companies and even entire industries are struggling.

Today's semiconductor supply chain is incredibly complex, with innovation happening at various stages in different supply chains globally. The United States can no longer single-handedly suppress China's semiconductor development, although it has temporarily locked down certain aspects through various agreements. China has already become an economic powerhouse through the export of products manufactured using imported American semiconductor technology, and its rise as a technological powerhouse is imminent.

The development of AI technology in the next wave will determine the next global political superpower. It's fascinating how such a small chip can reveal the intricate interplay between technology, politics, and economic development, right?

(Note: This is probably only gotta get 2s on #levelofanalysis #systemmapping #systemdynamics hahah)